Grain price: Winter plantings down; French wheat up slightly

The rain of the past few weeks has stopped any further winter sowing and estimates now put winter cereal area at 50% of last year’s area – 154,400ha.

Many winter crops are also struggling in the wet and cold conditions. This story is similar in Europe.

UK planting survey

In the UK, the Agriculture and Horticulture Development Board’s (AHDB’s) early-bird survey shows that farmers across the UK intended to plant 10% less wheat for the 2020 season. However, some reports are suggesting that winter wheat area could actually be down by as much as 20%.

The winter barley area is also expected to decline by 12%. This is due to the wet weather, but also a planned reduction in area.

England received 143% of the long-term average rainfall from August to October. This made 2019 the third wettest year in the last 20, according to the AHDB. Rainfall in November had totaled 101% of the long-term average up until November 28.

In France, MATIF wheat hit €183.50/t (December) yesterday afternoon, November 29. This rise on recent weeks may be put down to a struggle to plant winter crops in France and a decline in the quality of crops that are currently established. Some farmers are holding onto stocks as a result and in turn tightening supplies.

In the US

This may also be a contributing factor to the rise in Chicago Board of Trade (CBOT) wheat prices.

The area of winter wheat looks set for a decline and the quality of crops planted is mixed. In the latest United States Department of Agriculture (USDA) crop progress report (November 25), just 11% of the wheat was rated in excellent condition, while 41% was in good condition and 34% was in fair condition. The remainder was in poor (10%) and very poor condition (4%).

As of November 24, 94% of US soybeans had been harvested, while 84% of US corn had been harvested.

Grain markets

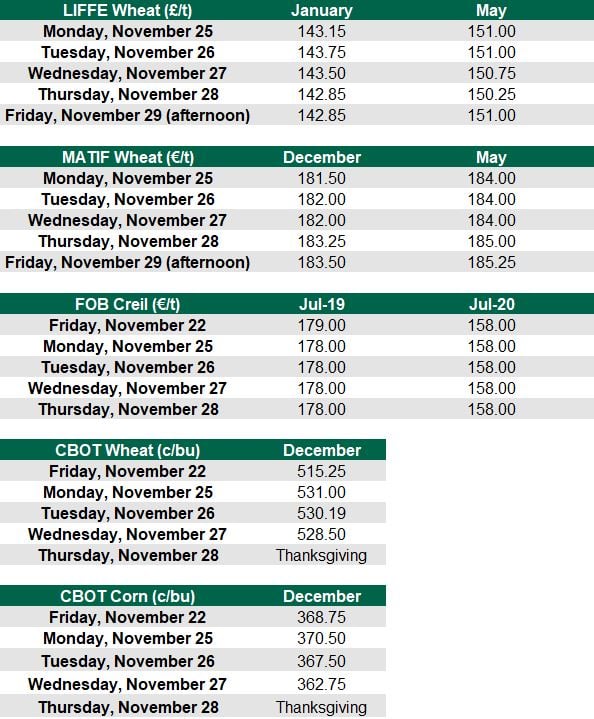

LIFFE wheat hasn’t changed much from last week. MATIF and CBOT wheat are up slightly and CBOT corn dropped a few cents. Free-On-Board Creil, two-row malting barley did not move across the week.

At home, farmers supplying Boortmalt were offered a fixed price of €180/t for next harvest, which is available on up to 20% of their 2020 malting barley contract.